- Home

- About

-

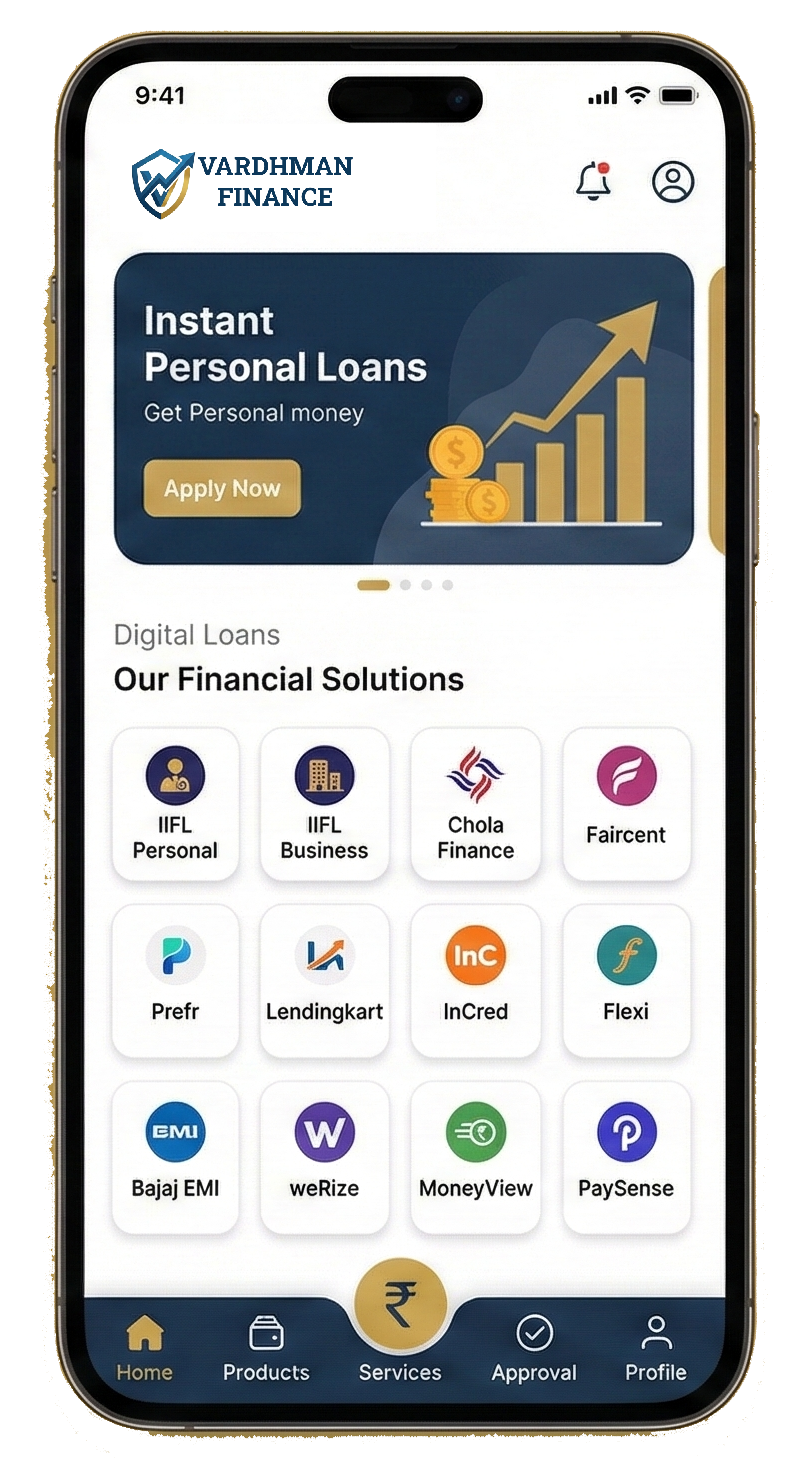

Apply Loan

Retail & Personal

Business & Corporate

- Private Funding

-

Join

Partner With Us

Employee Zone

Grow With Us

Become a part of our success story.

-

Insights

Explore

Expert Guides

Financial Glossary

- Contact Us